State Bank of India is the leading bank in the country that offers various banking products and services to customers. SBI Credit Card provides beneficial features to the users. SBI offers different types of credit cards to the users so that they can meet their financial needs at some point of time every month. SBI Credit Card Limit is referred to the amount that a customer can spend on their credit card for a given period. Three types of credit card limits are available for SBI cardholders. It includes the total credit limit, available credit limit, and cash limit. To know more about the SBI Credit Card Limit, the procedure to check and increase the limit, required documents, and more, just go through this in-depth guide. Have a glance!

Table of Contents

How to Check Your SBI Credit Card Limit?

The cardholders can easily check the SBI credit card limit in 4 different ways. The customers can access their card limit through net banking, mobile app, SMS, and more. Check it out!

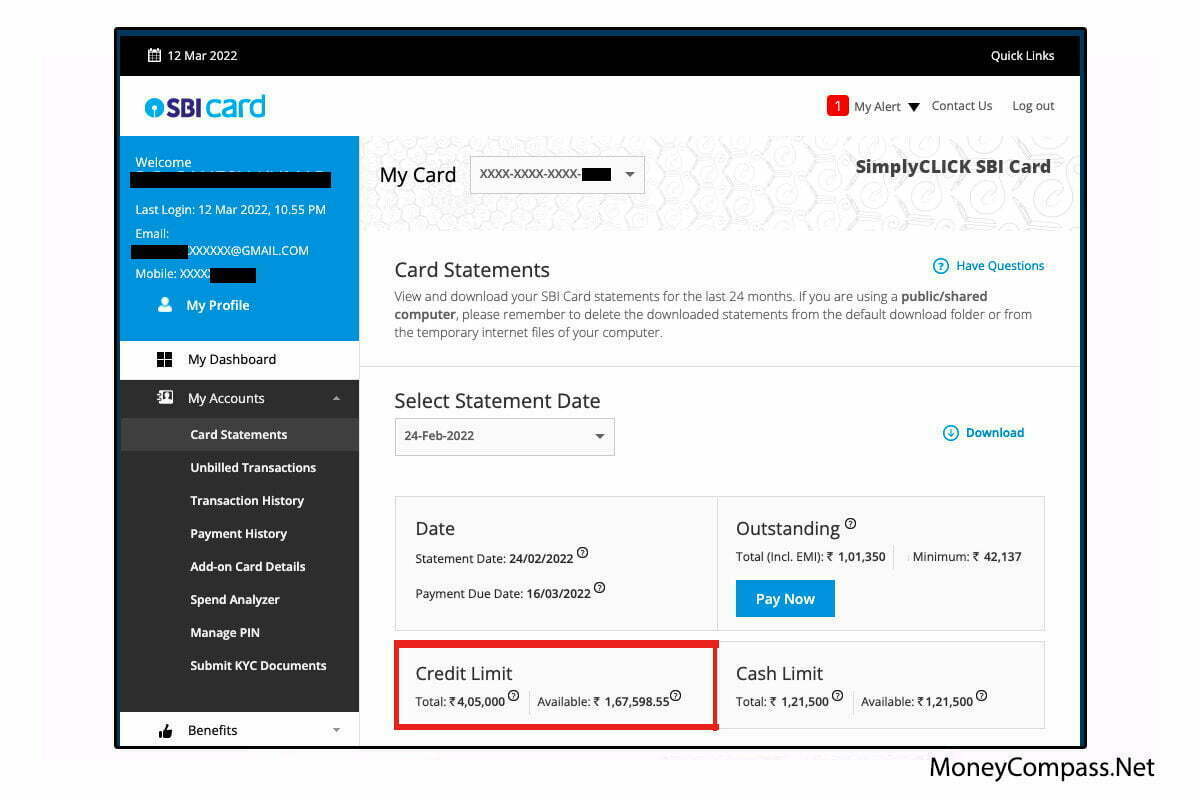

1. Check SBI Credit Card Limit from SBI Card Website

- To check your SBI Credit Card Limit, you can access your online account through SBI net banking.

- Log into the official website of SBI using vital login credentials such as the user id and password.

- On the left side of the screen, you can see the dashboard with a slew of options.

- Click the ‘My Account’ option and select ‘Card Statement’ from the drop-down menu.

- In a few seconds, you can see the Credit limit displayed on the screen.

- It shows the Total Credit Limit and Available Credit Limit on your card.

- You can also check the total and available cash limit on SBI Credit Card.

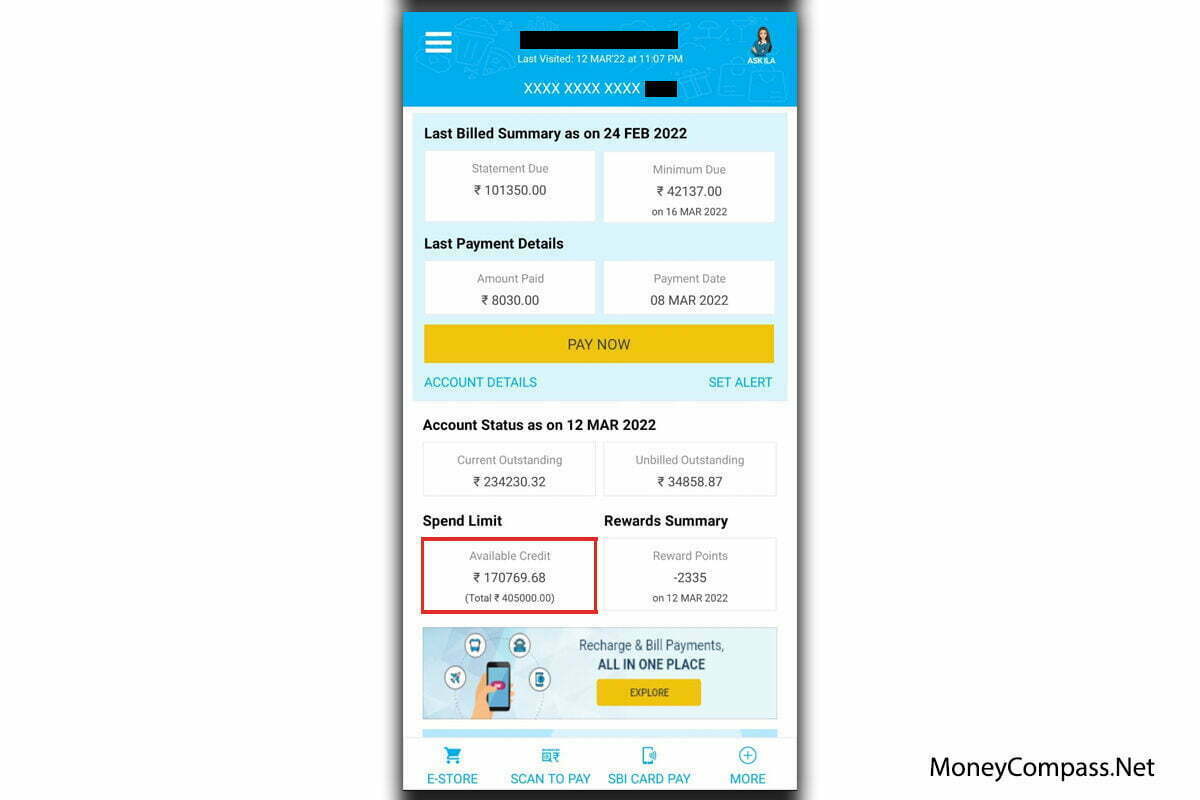

2.Check SBI Credit Limit Through Mobile App

Another way of checking your SBI Credit Card Limit is using the SBI Card Mobile App.

- Download and install the SBI Card mobile app on your phone.

- Once the installation is finished, you can open the app.

- Log into the account using the User ID and Password.

- On the next screen, you can check your credit card limit under the ‘My Account’ section.

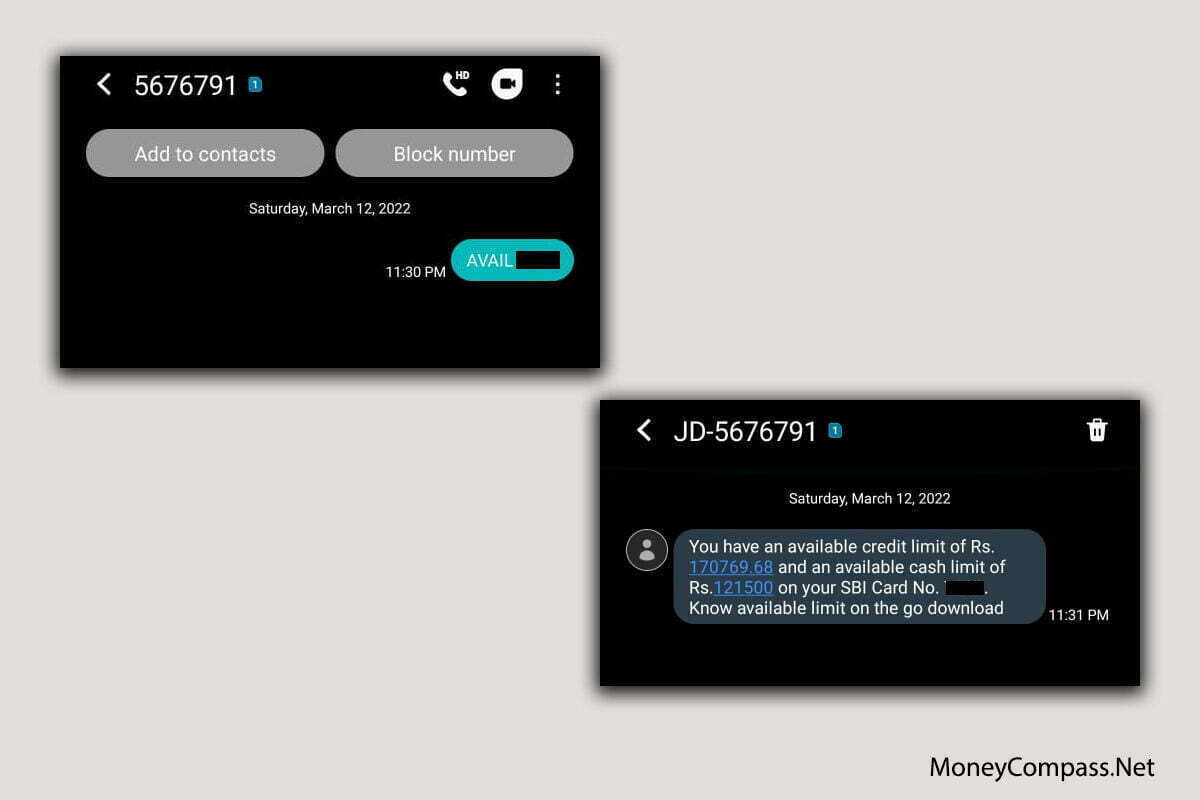

3.Check SBI Credit Card Limit By SMS

To access the SBI credit card limit check, you can utilize the SMS option. All you need to do is send an SMS in a specific format and get to know your available credit card limit.

Type AVAIL ‘0000’ and send it to 5676791 from your registered mobile number.

0000 is the last 4 digits of your SBI Credit Card.

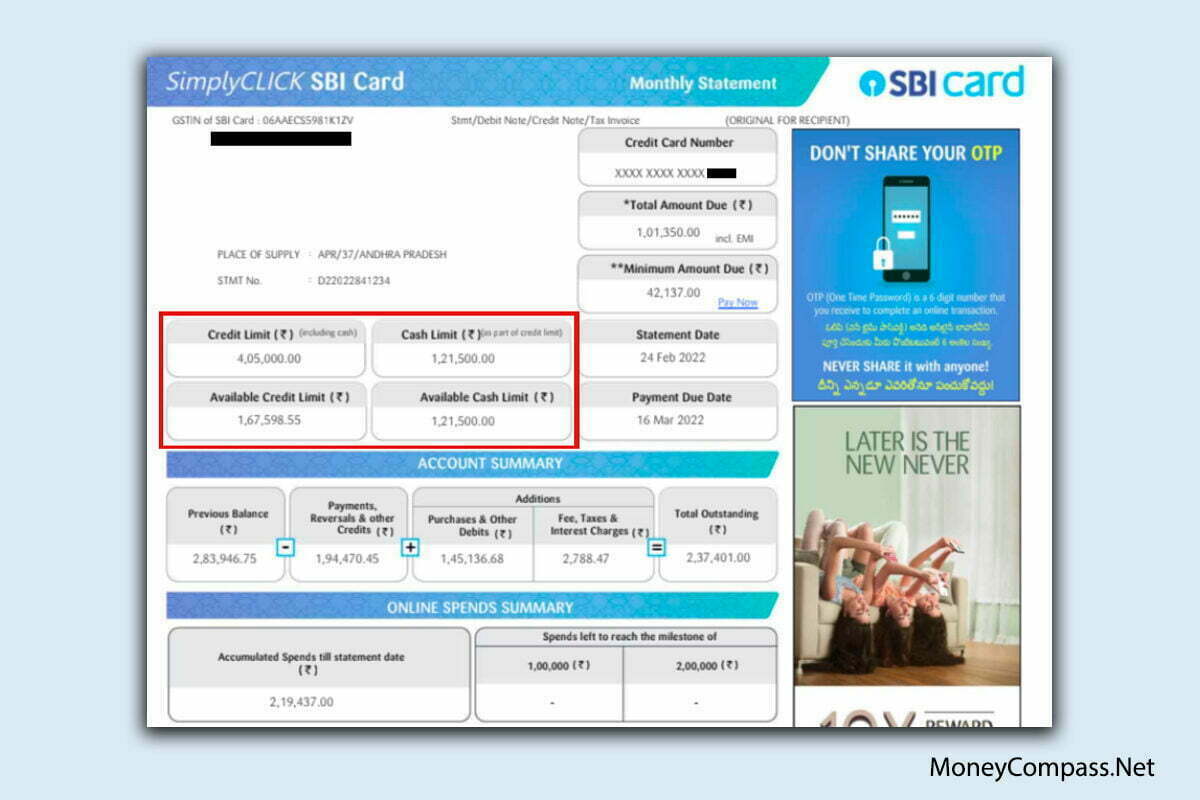

4.Check SBI Credit Card Limit Through Statement

The cardholders can also check their SBI Credit Card Maximum Limit through the credit card statement. The cardholders will receive the card statement through SMS and Email. The customers will receive an email to their registered email id comprising the monthly credit card statement. It includes the current credit card limit of the customer such as the total and available limit.

How to Increase SBI Credit Card Limit?

SBI Credit Cardholders have a facility to get their credit limit revised i.e., increased in different ways. SBI frequently finds particular cardholders for a Pre-approved Credit Limit Increase offer as per SBI internal policies. In that case, some of the eligible cardholders can get an increased credit limit offer via their registered mobile number using different ways such as SMS, email, credit card monthly statement, and more. The credit cardholders need not require additional documentation to avail of this credit limit increase offer. Let’s dive into the ways that help you understand how to increase SBI credit card limit!

1. Pre-approved Credit Limit Offer (Zero document approval)

State Bank of India follows specific internal policies. Based on a specific internal policy, SBI Card picks specific credit cardholders for a pre-approved credit limit offer. If the cardholders acquire this offer, they have a chance to increase their credit limit. SBI credit card limit increase helps the cardholders spend some additional amount on their credit card every month. The eligible cardholders will receive a confirmation regarding the same through an SMS, or email to their registered mobile and email id. Some of them can even get this pre-approved credit limit offer information via credit card statement.

Once you are willing to avail of this offer, you can select any of the methods listed below:

A. Increase Credit Limit Through SBI Card Website

Follow the simple steps given below to utilize SBI credit card maximum limit increase offer through net banking.

- First of all, go to the official website of the State Bank of India.

- On the home page of the website, you can click on the ‘login’ button.

- Fill in your vital login details such as the User ID and Password in the provided fields.

- Hit the Login button.

- On the dashboard of your account, you can find the link ‘Credit Card – Card Upgrade with Enhancement.’

- Select your SBI Credit Card and tap the Continue button.

- If you are eligible for the offer, you can see a pop-up message displayed on the screen. It also displays the applicable credit limit.

- After learning all the details about the SBI credit card limit increase, you can proceed to upgrade the card.

- Hit the submit button to access the offer.

- The concerned authorities of the card will approve your credit card limit increase request.

- You will receive a letter to your registered address within 7 to 10 working days.

- All your rewards, transactions, and dues on your previous card will be transferred to the new credit card. Customers can check their transactions in the transaction history.

- As you have applied for an increase in the credit limit, you can also witness the limit extension for the card.

B. Increase SBI Card Credit Limit Through SMS

Sending an SMS from your registered mobile number is another way of increasing the SBI Credit Card Limit. Send an SMS in a particular format and you will get to know whether you are eligible for the offer or not.

Type INCR 0000 [0000 is the last 4 digits of your credit card number] and send it to 5676791 from your registered mobile number.

C.Increase SBI Card Credit Limit Using Chatbot ILA

State Bank of India provides an Interactive Live Assistant to the customers that helps them get to know more details about bank products and services. The users can learn how to increase SBI credit card limit through chatbot ILA.

- Visit the SBI website.

- You can find the ILA option at the bottom right corner of the screen.

- Log into Chatbot ILA. Request for a credit limit increase and follow the on-screen instructions.

D.Increase SBI Card Credit Limit Through Customer Care

To increase your Credit Card Limit, you can use SBI Card Helpline Number or customer care. Just call on 1860 180 1290 or 39 02 02 02 [prefix STD code] to request for SBI credit card limit increase.

2. Submitting Income Documentation

The customers can increase their SBI Credit Limit through income documentation. You can submit all the income-related documents to the bank executives to increase the credit card limit. There are 2 different ways to increase credit limit with income documentation. You can send an email at sbicard.com/email and get a reply from the bank within 2 working days. Otherwise, you can call the customer care on the SBI Card helpline number at 39 02 02 02 (prefix STD code) or 1860 180 1290. Get information regarding your eligibility for a credit limit increase from the customer care executive and income documents as well.

Documents Required to Increase SBI Card Limit

Check the list of documents required to apply for a Credit Limit Increase:

- Form 16

- ITR VI

- Last 2 months Pay Slips

The customers can submit soft copies of the aforementioned documents through email.

Another way is to send the documents through the post at:

Correspondence Department,

DLF Infinity Towers,

Tower C, 10-12 Floor,

Block 2, Building 3,

DLF Cyber City, Gurgaon – 122002

Once your request is received by the executives, they will review the documents. The credit limit increase request will be approved as per the internal policy of SBI.

SBI Credit Card Limit FAQs

People might get some doubts and queries about the SBI Credit Card Limit. To clear all your queries, we have included some of the frequently asked questions and answers in this post. Check it out!

What is the difference between Total credit limit & Available credit limit?

The total credit limit is the maximum credit limit that the customers can get on their credit card. On the other hand, the available credit limit is the credit amount available for purchases to date.

Will my credit score be affected if I get my credit limit increased?

If you don’t increase your expenditure too much and continue to make payments on time, your credit score may not be negatively affected by a credit limit increase.

How many days it will take to process SBI credit limit increase request?

It takes about 5 days to process the SBI Credit Limit increase request. If your credit limit isn’t increased after 5 days, you can contact SBI Card Customer Support.

Can I spend more than the available credit limit on SBI Card?

No, you can only spend the amount which is given on your credit card limit. In case, you have a good credit history and perfect repayment track record, SBI might approve your over-the-limit transaction.

Well, this is everything you need to know about the SBI Credit Card Limit. We hope this guide has given enough information about the SBI Credit Card Limit increase, maximum limit, and more. If you still have any doubts, just ask us in the comments section. For more related articles, stay tuned to this website. Visit our website MoneyCompass frequently to learn more about SBI credit cards, benefits, etc.