Have you ever faced a transaction failure? Mostly, everyone experiences a few situations like payment failed or stuck payment and sometimes unsuccessful transactions at some or other point in time. In some situations, you try to transfer funds via NEFT or RTGS but, the transfer takes a long time than expected. This is where the UTR point enters the scene.

Whether your transaction has failed because of some technical issue or something else and you don’t get any confirmation message regarding the payment then, UTR helps you to track the transaction status. So, what is UTR in banking terms? We help you understand more about the UTR Number SBI, how to track the UTR Status of a specific transaction, and more through this in-depth guide. What are you waiting for? Let’s dive into the actual info!

Table of Contents

What Is UTR Number?

A UTR is an acronym for Unique Transaction Reference Number. UTR is a reference number that aids in identifying a specific transaction performed in India. No two transactions have the same UTR. That’s why this number is referred to as the Unique Transaction Reference number. A Unique Transaction Reference Number is generated whilst transferring funds via RTGS, NEFT, and UPI.

Real-time Gross Settlement, Unified Payments Interface System, and National Electronic Funds Transfer are three different modes of funds transfer that can be accessed by the people holding an account in any bank. So, whenever you make a transaction through any of the modes, UTR is generated to identify your transaction.

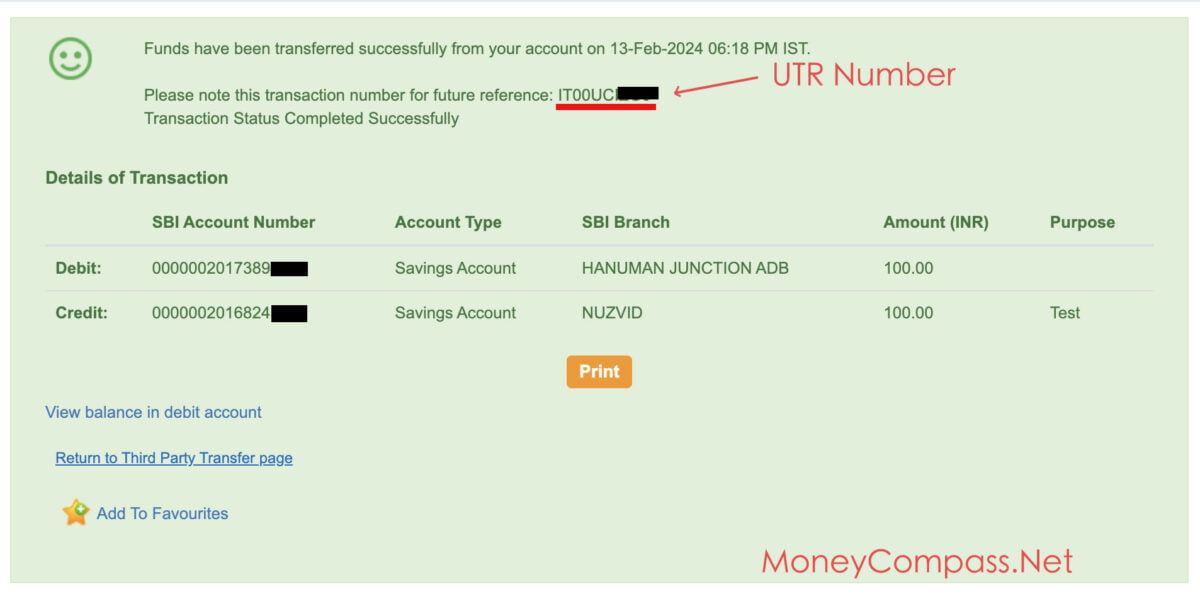

For each transaction, a unique UTR is generated and the format of UTR is completely predefined by the SBI bank whilst the transaction initiation. As a result, this UTR number is used to track the SBI Transaction Status. A UTR number simplifies the transaction tracking process to the bank representative and the person who initiated the transaction. Not only SBI, but every bank in the country utilizes the UTR numbers at the time of local funds transfer.

The UTR number plays a crucial role in every transaction be it an RTGS, NEFT, or UPI payment mode. IMPS Reference Number Tracking SBI transaction status becomes pretty much easier and quick with the UTR number. According to the norms and regulations of the Reserve Bank of India, a UTR number is a 16-digit unique code comprising only the numeric code and sometimes alpha-numeric code.

The character length of the UTR number depends on the mode of payment. For RTGS payment mode, the UTR Number comprises 22 digits or characters. In the case of NEFT Payment, the UTR Number consists of 16 characters. However, it varies from one bank to another bank. No bank follows a standard format for the UTR number.

Here’s what a UTR Number arrangement looks like:

XXXXRCYYYYDDD555555

In this format, each character has a specific meaning. Check it out!

- XXXX represents the Code of the Bank. For instance, the code of SBI Bank is SBIN.

- R indicates RTGS Payment mode (N for NEFT, I for IMPS)

- C Indicates the Transaction Channel

- YYYY indicates the Year of transaction

- DDD indicates the Julian Date of the transaction (Ex: 062 for 3rd March)

- 555555 [For instance] indicates the sequence numbers

Find SBI Transaction Reference Number From Statement

Now, you may get a doubt that where can I find this UTR Number? Well, as we have mentioned earlier, a unique transaction reference number is generated for each transaction. One of the fastest ways to find the SBI NEFT Reference Number or any other mode of the transaction [RTGS/UPI] is from your bank account statement.

In case, you have performed a transaction [NEFT/RTGS/IMPS] via net banking from the official SBI website then, you can find the UTR Number SBI by visiting your net banking account. If in case, you have initiated a transaction via any of the UPI apps from your mobile, you can find the UTR right in your UPI app.

Through net banking or using your bank-related mobile app, you can easily view or download the account statement. The SBI Reference Number displays next to the transaction date in the account statement. If you aren’t aware of the process, just go through the detailed guide on how to find the SBI NEFT Reference Number from the bank account statement. Check it out!

- First of all, visit the official SBI website.

- Log into your account using the login details such as the Username and Password.

- Click on the ‘Login’ button.

- As you want to find the UTR Number from the bank account statement, you need to click on the tab ‘My Accounts & Profile’.

- From the list of options, you need to click on the option ‘Account Statement’.

- Further, you need to select your account. It shows your account number, account type, and branch.

- Below that, you need to choose options for the statement period.

- You will get 4 different options to get the bank account statement period i.e., by date, by month, last 6 months, and FY [PPF Account].

- Select your preferred option.

- Enter the start date and end date in the given fields.

- Based on your choice, you can either view or download the account statement.

- On the next page, you can find a list of all transactions. The UTR number will be shown next to the transaction date.

- If you want to download the statement, you can do it either in PDF Format or MS Excel Format. Select your preferred option.

- Click on the ‘GO’ button.

That’s all! This way, you can easily find the UTR Number SBI from the account statement.

How To Track Your UTR Status In OnlineSBI?

OnlineSBI is the official web portal of the State Bank of India. If you have been using a net banking account already then, you can easily track the SBI Transaction Status online. For that, you need to follow the step-by-step procedure furnished below:

Step 1: Visit Official Website

- Initially, log into the SBI net banking account i.e., at onlinesbi.

- On the home page of the website, you can find the option ‘Login’ below the Personal Banking section. Just click on it.

Step 2: Log into your Account

- On the next page, tap on the button ‘Continue to Login.’

- You will be redirected to a new web page wherein you are prompted to enter your vital login credentials.

- Enter the Username, Password, and a random Captcha Code in the provided fields.

- Hit the Login button.

Step 3: Request for Status Enquiry

- Once you acquire net banking account access, you will land on your account’s dashboard.

- A series of tabs will be displayed on the top menu of the screen.

- From the list, you need to click on the tab ‘Request & Enquiries’.

- From the drop-down menu, click on the ‘More’ option.

- A list of options will be shown on the screen.

- Click on the option ‘Status Enquiry’.

Step 4: Choose your Transaction Date Range

- You need to select a date range for which you wish to check the transaction information.

- Choose the starting date and ending date from the given fields.

- Just click on the ‘View’ button at the bottom of the page.

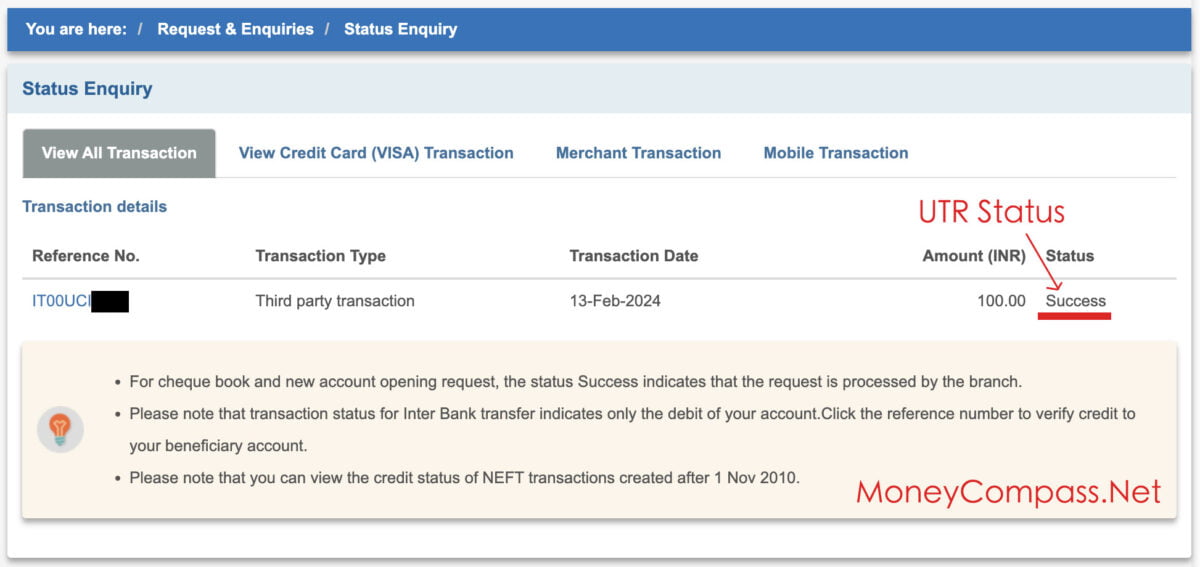

Step 5: Track your UTR Status

- A list of transactions that you had performed in that particular date range will be shown on the screen.

- It comprises all your transaction details such as the transaction type, reference number, transaction date, transacted amount, and status.

- Hit the link ‘Click here’ next to your selected transaction.

- On the next screen, you can find the UTR Number for that particular transaction alongside the SBI Transaction Status for your NEFT or RTGS, or IMPS transaction.

- Next to the Debit Status option, you can check your transaction status i.e., ‘Processed’.

Conclusion

That’s it! This is everything you need to know about the in-depth information about the UTR Number SBI. We hope this guide has covered the crucial points about the procedure to Track UTR Number SBI and find the SBI NEFT Reference Number easily. If you still have any doubts or queries over this topic, feel free to ask us in the comments space. Stay in touch with our website MoneyCompass.Net for articles based on SBI accounts, different payment systems of SBI, and more.