A Credit Card is one of the most popular financial products available to customers. Credit cards have been playing a key role in the financial sector as it has changed the way of the worldwide economy. A credit card generates financial independence for the customers to make a purchase now and pay for the same later. However, there are some drawbacks of a credit card if it is not utilized wisely. The banks provide credit card e-statements so that the customers can keep a track of their credit card expenses frequently. If you are using SBI Credit Card, you can check the statement easily. We furnished different ways to access SBI Credit Card Statement in this post. Check it out!

Table of Contents

- What is SBI Credit Card Statement?

- How to Check SBI Credit Card Statement?

- 1. Check SBI Credit Card Statement on SBI Card Website

- 2. Check SBI Credit Card Statement Without Login Credentials

- 3. Check SBI Credit Card Statement using SBI Card Mobile App

- 4. View SBI Card Statement using ILA

- 5. Open SBI Credit Card E-Statement PDF Using Password

- 6. Get SBI Credit Card Statement by SMS

- 7. Get SBI Card Statement Via Call

- 8. Get SBI Credit Card Physical Statement by Requesting at Nearest Branch

- Understanding your SBI Credit Card Statement

- SBI Credit Card Statement FAQs

What is SBI Credit Card Statement?

SBI Credit Card Statement is a detailed report issued to the customers monthly that tells about their outstanding debt. The card statement comprises the credit card usage history for a specific billing period. In general, the credit card billing statement comes in 2 pages. State Bank of India is the biggest public sector bank in India that offers various products and services to customers. To handle your budget management, an SBI credit card statement is highly beneficial. All your credit card-related transactions and the information about the amount that you have paid in the previous month, the amount you must pay and the payment deadline will be present in the SBI card statement. Customers can also check for all the transactions on the card in the transaction history. To evade penalties, you need to pay the credit card dues before the last date. The customers can check their credit card statement in different ways that include online, offline, registered email id, and more.

How to Check SBI Credit Card Statement?

SBI provides a service of e-statements to the customers that help them track their credit card expenses. If you are not aware of the procedure on How to check SBI credit card statement, this guide will help you. There are a total of 8 different ways that enable the customers to access the SBI credit card statement download. Have a look!

1. Check SBI Credit Card Statement on SBI Card Website

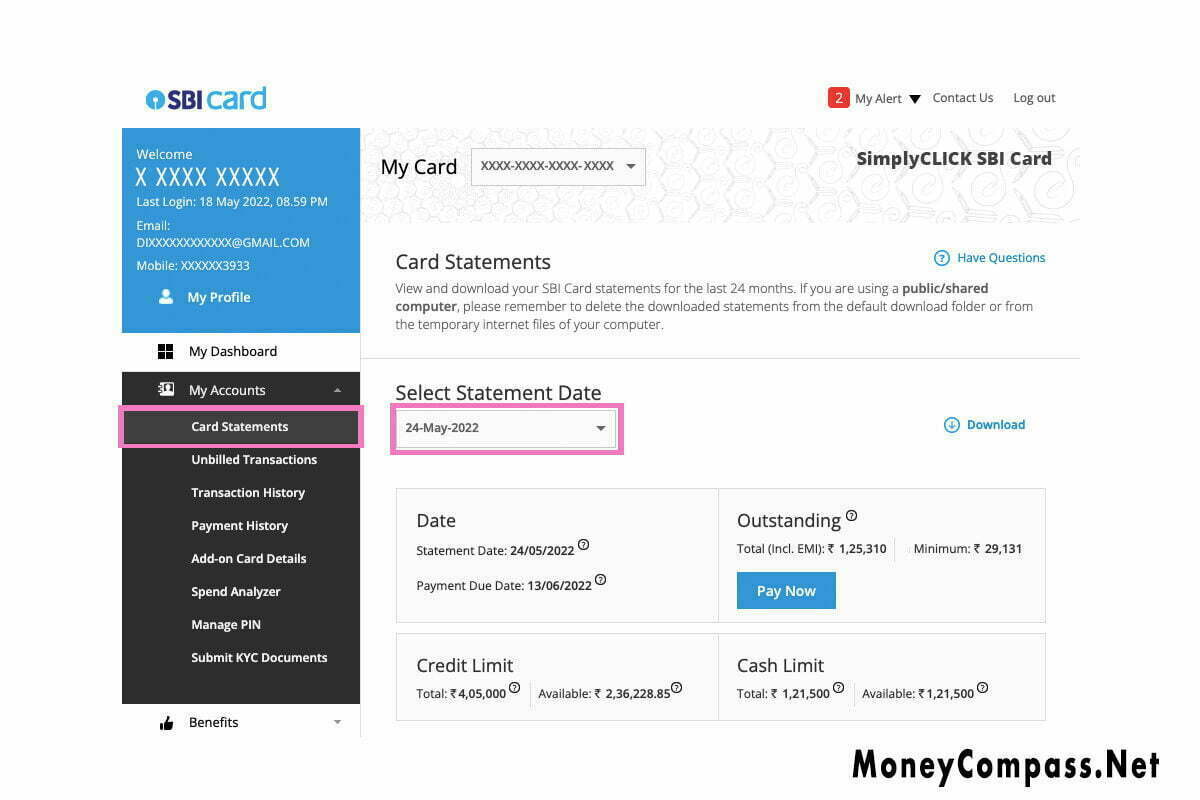

Follow the easy steps furnished below that helps the customers to check SBI Credit Card Statement through the SBI Card website.

- Visit the official website of the State Bank of India i.e., www.sbicard.com.

- On the home page of the website, you can find the Login button on the right side of the page to log in to the account.

- On the next page, you need to fill in the login credentials such as the User ID and Password.

- Hit the Login button.

- On the next page, you can find a dashboard.

- Click on the option My Accounts >> Card Statements.

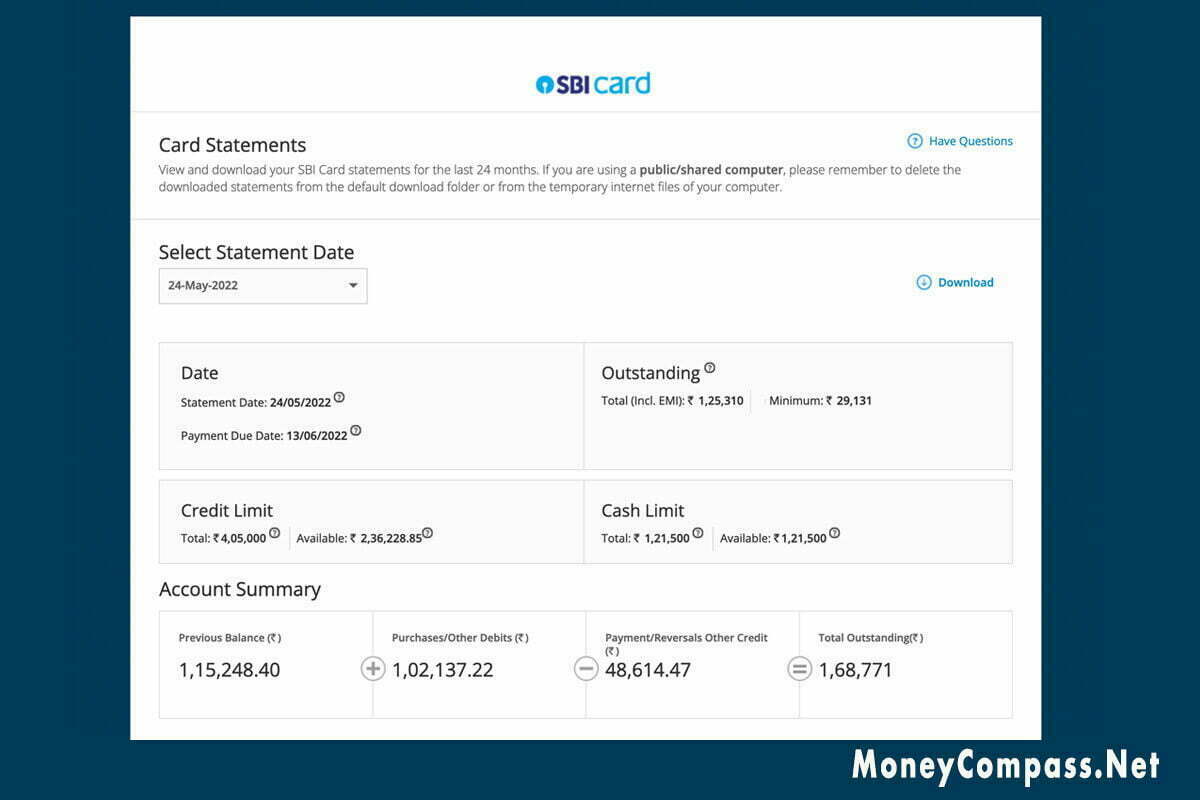

- On the next window, it prompts you to select the statement date. From the drop-down menu, you need to select the month, date, and year of the credit card statement.

- In a few seconds, the credit card statement will be displayed on the screen.

- It shows the account summary with the total outstanding amount.

- It also displays the transactions on the account, rewards summary, total savings and benefits, and details about other value-added services.

That’s all! This is an easy process to access the SBI credit card statement online.

2. Check SBI Credit Card Statement Without Login Credentials

Do you have an SBI Credit Card? But, if you don’t have the card login credentials, just don’t worry. Want to know how to open SBI credit card statement? There is a possibility to check the SBI credit card statement without login credentials. All you need to have is the 16-digit SBI Credit Card number, registered mobile number, and date of birth. Check the procedure to open the SBI Credit Card statement without login details in this post.

- Visit the official website of SBI.

- Click the following link:

- https://www.sbicard.com/creditcards/app/service/card-statement-page

- On that page, you need to enter the 16-digit SBI Credit Card number and date of birth in the given fields.

- Enter the captcha code displayed on the screen.

- Hit the Proceed button.

- You will receive an OTP on your registered mobile number.

- On the next page, you need to enter the OTP in the provided field.

- Click the Continue button.

- On the next page, you can view the SBI Credit Card latest statement.

- If required, you can even download the credit card statement in PDF format for the last 24 months.

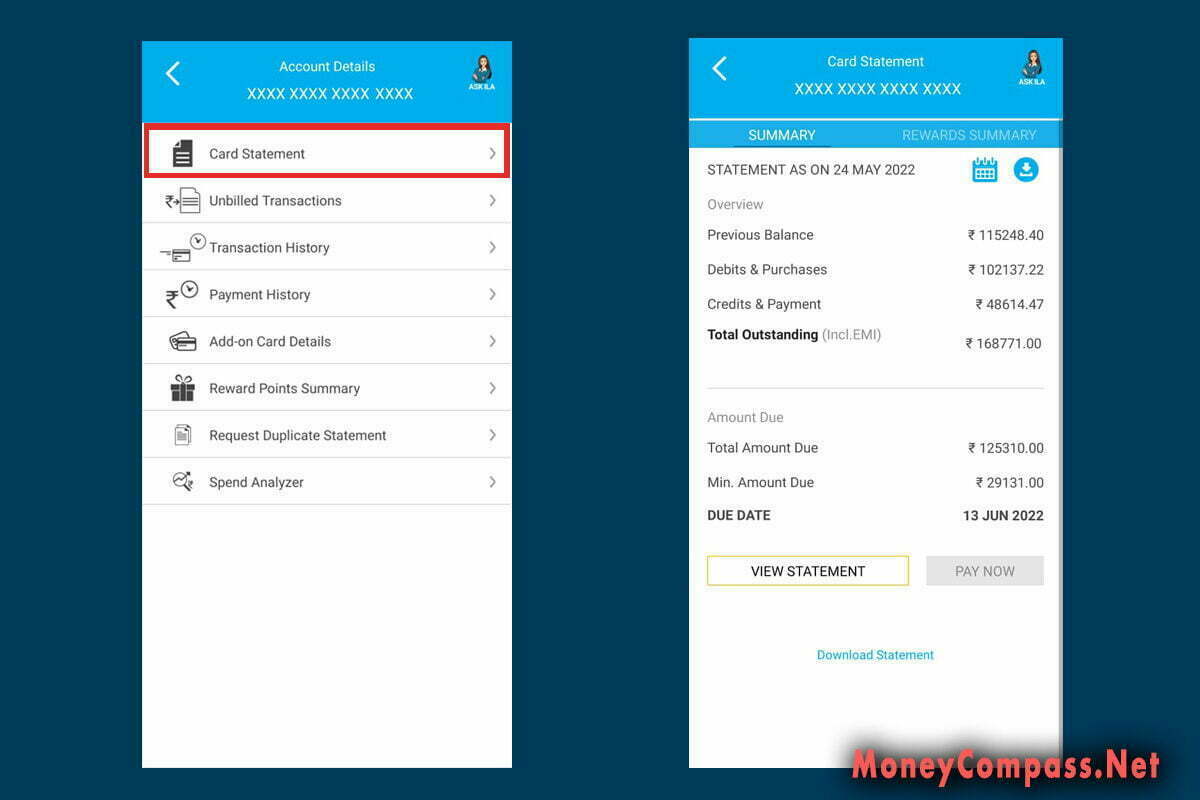

3. Check SBI Credit Card Statement using SBI Card Mobile App

The customers can access their SBI Credit Card Statement details using SBI Card Mobile App. Check the steps given below to download the card statement via the mobile app.

- At first, go to the App Store from your Android or iOS device.

- Search for SBI Card app in the search tab.

- Hit the Install button.

- In a few seconds, the SBI Card will be installed on your phone.

- Once the installation process is finished, you need to log into the app.

- Create new login credentials, reset password and access the SBI card app.

- Log in to the app using the username and password.

- On the main screen, you can tap on the tab ‘Account Details.’

- On the next screen, tap on the option ‘Card Statement’ to check the account summary.

- To check the transaction details on your credit card, click on ‘View Statement.’

- Select the date range that you want to view your previous statements of your SBI Credit Card.

- All the transactions from your selected date range will be displayed on the screen.

- That’s all! This is the complete procedure to view your SBI Credit Card statement using the SBI Card Mobile App.

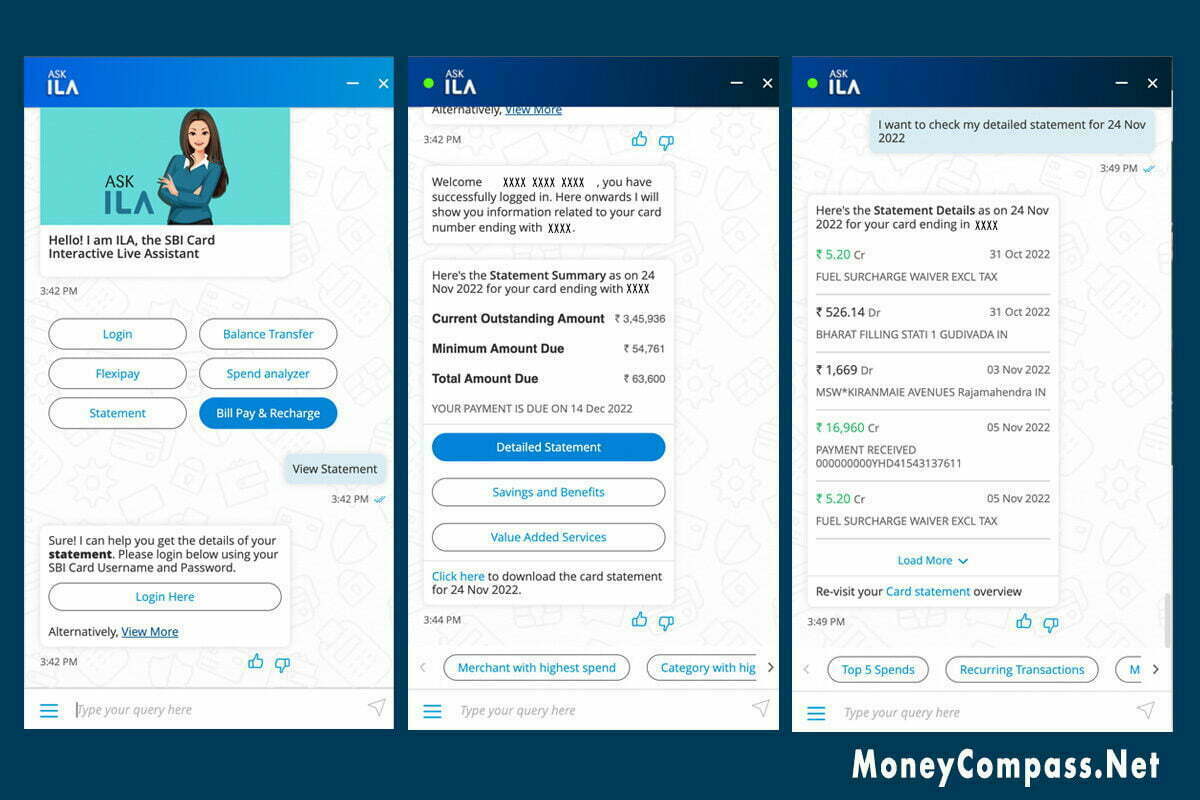

4. View SBI Card Statement using ILA

Wondering how to open SBI Credit Card Statement. Here’s ILA to make it simple for you! The customers have another way to check SBI Card Statement using ILA. ILA is an interactive live assistant that can help you give some information about SBI services such as the statement, login, balance transfer, and more. Check the procedure given below to get SBI credit card statement download using ILA.

- Visit sbicard.com from your device.

- On the right bottom corner, you can find the ‘Ask ILA’ tab.

- Click on it.

- A list of options will be displayed on the screen.

- Type ‘View Statement’ in the space provided below.

- Hit the enter button.

- ILA gives a reply immediately to Log into your account.

- Tap the ‘Login Here’ button.

- Using the login credentials, log into the account.

- It then displays 3 different options – Detailed Statement, Savings and Benefits, and Value Added Services.

- Tap on the option ‘Detailed Statement’ to get a detailed report on your credit card transactions and expenditure.

- The complete statement details till date for your credit card will be displayed on the screen.

- If you want to know your reward details, click on the link ‘Savings and Benefits.’

- This way, you can check the SBI Credit Card Statement easily using ILA [Interactive Live Assistant].

5. Open SBI Credit Card E-Statement PDF Using Password

Want to know how to open SBI credit card statement PDF password? This post will help you understand the procedure to open the card e-statement. The customers can access their credit card statement using e-statement. The e-statement will be received to the email id of the customers and it is password-protected. To view your password-protected SBI credit card statement password, you need to enter the password in a specific format.

Earlier, the customers need to enter their 16-digit primary card number to open the credit card statement.

Now, the bank has changed the format of viewing the password-protected e-statement. The new password must comprise the customer’s Date of Birth in DDMMYYYY format followed by the last 4 digits of the credit card.

For example, If your Date of Birth is 10/12/1990 and your credit card’s last 4 digits are 1234 then, your password will be 101219901234.

6. Get SBI Credit Card Statement by SMS

Besides the above ways, the customers can also check SBI Credit Card Statement by sending an SMS. It is considered an offline procedure to access the card statement. Credit card customers can get SMS services from the State Bank of India such as the latest updates, statements, and more. All you need to do is to send an SMS to 5676791 from your registered mobile number.

To access the SBI Credit Card Statement through SMS, send the message in the following format:

SMS ESTMT XXXX to 5676791. XXXX is the last 4 digits of your SBI credit card.

7. Get SBI Card Statement Via Call

State Bank of India offers a missed call service to its credit cardholders. The customers can check their outstanding dues and the current available limit of your credit card just by giving a missed call from your registered mobile number.

Call 8422845513 from your registered mobile number. In a couple of seconds, you will get the current available credit limit to your mobile.

Call 8422845512 from your registered mobile number. In a couple of seconds, you will receive the total outstanding amount through SMS to your mobile.

You can even call the customer care service to know your credit card statement.

SBI Credit Card Customer Care Numbers of India: 1860 180 1290, 1860 500 1290, or 39 02 02 02.

8. Get SBI Credit Card Physical Statement by Requesting at Nearest Branch

If you want to get an SBI Credit Card Physical Statement i.e., hardcopy of the statement, you can request it at the nearest SBI branch. In case, you have already accessed the SBI Credit Card e-statement, you may not get a physical statement. If you still want to get the credit card physical statement, you can visit the nearest SBI branch and speak to the bank representative requesting the statement. You need to provide some of your credit card details to receive a hard copy of the SBI credit card statement.

These are the different ways to check SBI Credit Card Statement and access the credit limit, overdue amount, transactions, and more.

Understanding your SBI Credit Card Statement

There are many ways to get SBI Credit Card Statement as explained above. The cardholder will receive various details about the credit card transactions, dues, limit, and more. The credit card statement includes the name of the cardholder, email address, residence address, and more. It also comprises all the domestic transactions carried out via credit card. The credit card statement includes the date, amount, and transaction details of all the purchases made through the card.

Under the ‘Account Summary’ section, you can find the information regarding the opening and closing balance, purchases made through the card, payment details, finance charges, and total dues on the card. The customers can also view the credit card offers and the latest products and services rolled out by the bank will be included in the credit card statement. In this post, we listed the complete information included in the SBI Credit Card Statement.

Under the section ‘Statement of the [xxx] Card’, the sub-sections include the following:

- Total Dues

- Available Cash Limit

- Available Credit Limit

- Minimum Amount Due

- Credit Limit

- Payment Due Date

Under the ‘Past Dues’ section, the list of information includes the following:

- Current Dues

- Over Limit

- Minimum Amount Due

- One Month

- Two Months +

- Three Months +

Under the ‘Rewards Points Summary’ section, the information includes the following:

- Opening and Closing Balance

- Earned Points

- Adjusted Points

- Disbursed Points

Well, this is the complete information displayed on the SBI Credit Card Statement.

SBI Credit Card Statement FAQs

The credit cardholders may have abundant queries and doubts about the way of getting an SBI Credit Card statement. In this post, we provided frequently asked questions along with answers. Check it out!

How many days it will take to get SBI Credit Card e-statement?

After making a request, the cardholder will receive the SBI Credit Card e-Statement in their email within 3 days from the date of generation. In the case of the physical statement, the cardholder will receive it in 10 calendar days through postal services.

Are there any charges for SBI Card e-statements?

No charges or fees are imposed on the cardholders by the State Bank of India for receiving credit card e-statement.

Will bank stop sending physical statement after registering for E-Statement?

Yes. If you have already registered for credit card statements via email, the bank will not send the hard copies of the statement to the registered postal address of the customer.

What is the fee for SBI Card Duplicate physical statement?

The fee will be charged if you request the SBI Card Duplicate Physical Statement for more than 2 months period. The fee charged for the duplicate statement is Rs. 100 along with the applicable taxes per statement.

That’s all! This is everything you need to know about the SBI Credit Card Statement. We hope this guide has given enough information about the procedure to access the SBI Credit card statement download online and offline. If you still have any doubts, just ask using the comments space. For more related articles, stay tuned to this website. Bookmark our website to get the latest information about credit card benefits, usage, application procedures, and more.